A gift of stock or mutual funds can yield a wealth of benefits for you and for the Nature Trust.

By directly gifting stocks or mutual funds to the Nature Trust, you avoid capital gains tax on the appreciated value of your donated stocks. You also receive a charitable tax deduction for the fair market value of the stocks. So you receive significant tax benefits, and the Nature Trust receives the full value of the stocks.

It’s a very straightforward process. Simply complete this fillable form (or print and fill it out by hand) and give a copy to the Nature Trust and a copy to your broker.

The Advantages of Donating Securities instead of Cash

While donating securities is one of the most tax-smart ways to give, it is not widely used and perhaps not well understood. So, let’s take a quick look at why you should consider this kind of giving and how to go about it.

Greater Tax Savings Now:

People buy stocks/bonds/mutual funds (“securities”) because we hope that they will increase in value!

But, as soon as they do, we have what is referred to as a “capital gain,” which is just the amount the security has increased in value. And, sooner or later we will have to cash in these securities—and then pay tax on this increase—UNLESS we donate these securities to a registered charity such as the Nature Trust.

If you donate these appreciated securities to a registered charity, you do not have to pay tax on ANY of your capital gains for the securities donated.

In addition to getting a tax receipt for the full amount you donate, you also reduce your taxes by not having to pay tax on any capital gain for securities donated.

This can amount to a significant tax savings!

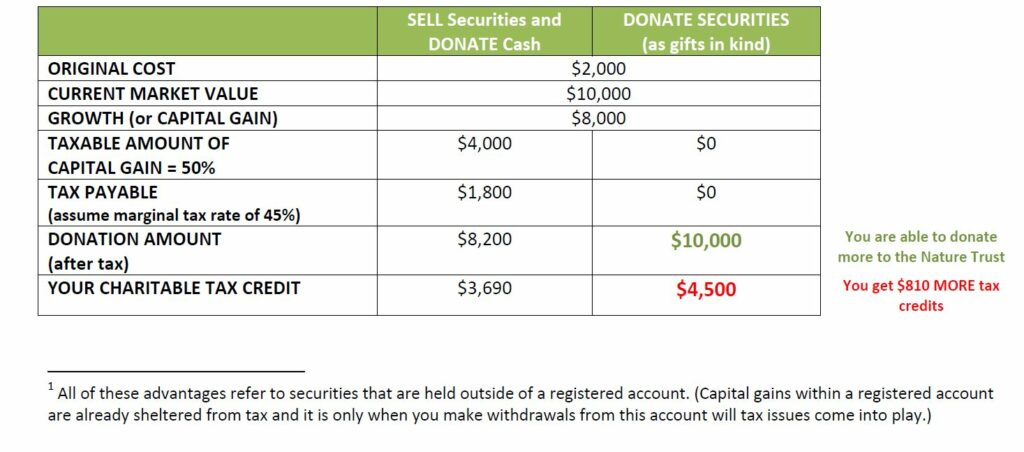

All of these advantages refer to securities that are held outside of a registered account. (Capital gains within a registered account are already sheltered from tax and it is only when you make withdrawals from this account will tax issues come into play.)

For example:

Additional Advantages:

Donating stock instead of cash gives you a chance to review and update your portfolio, reducing the capital gains held, which in turn will reduce future tax owing.

You’ll also be able to have a bigger impact on land conservation with the Nature Trust if you donate the additional tax savings from a stock donation.

As well, donating securities is easy to do. Just complete this fillable form as instructed. Give a copy to the Nature Trust and a copy to your Investment Company or Broker or Financial Advisor and we do the rest! Most companies do not charge you for making an in-kind stock donation, so it is even cheaper than writing a cheque! (Check with your own broker/company to make sure.)

A Few Things to Keep in Mind…

To take advantage of these benefits, security donations must be made “in-kind” meaning that the security is transferred directly to the Nature Trust — NOT cashed in first.

Security donations take longer to process than regular donations. This is especially important to keep in mind at year end. A security donation initiated in December 2024 but not received by us until January 2025 can ONLY be counted as a gift for the 2025 tax year. With holiday closures, an end of year gift can take even longer to process than usual, so please make sure you initiate your transfer early enough in the year if it is important for you to have a tax receipt for 2024.

The Federal Government has implemented these tax laws to help you donate to charity. The laws are designed to make it advantageous to donate securities instead of cash. “Ottawa’s rules are stretching clients’ donation dollars,” says Keith MacIntyre, a chartered accountant and partner at Grant Thornton LLP in Halifax.

For more information about donating securities, please contact Kerry Tench, Leadership Giving Advisor, at kerry@nsnt.ca or at (902) 802-1377.